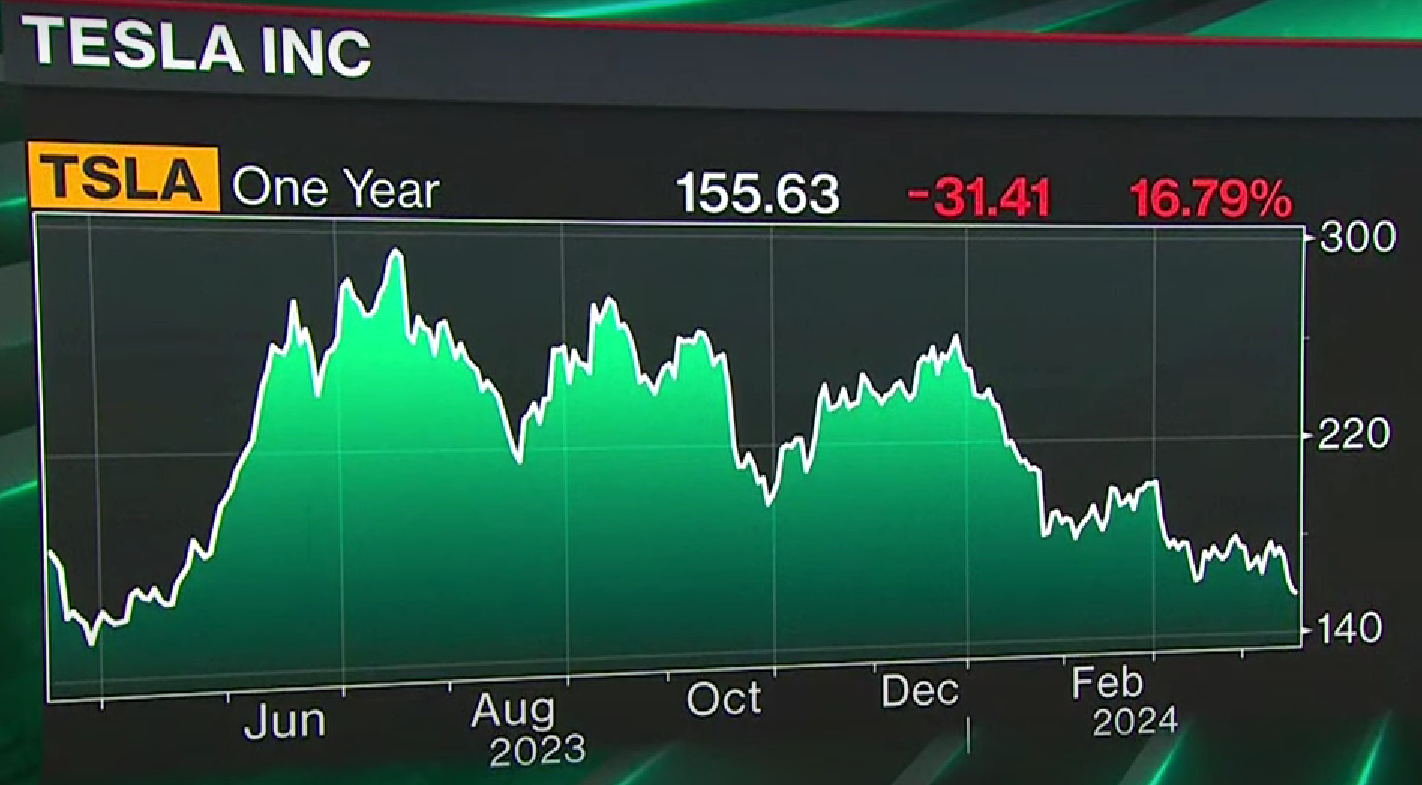

Tesla Seeks Shareholder Reapproval for Musk’s $56 Billion Compensation and Proposes Texas Relocation

Reinstatement of Musk’s Compensation

Tesla Inc. announced on Wednesday its intentions to seek shareholder reapproval for CEO Elon Musk’s $56 billion pay package, which was previously voided by a Delaware judge. The judge described the compensation deal as “deeply flawed.” This decision comes alongside the company’s proposal to relocate its incorporation from Delaware to Texas—a move suggested by Musk following the legal dispute over his compensation.

Controversial Proposals Ahead

The proposals, set to be highly contentious, involve not just reinstating Musk’s massive compensation but also a significant corporate move. Tesla has engaged the services of proxy solicitor Innisfree M&A, committing a substantial but undisclosed sum to secure shareholder votes. It is worth noting that Tesla has not utilized the services of Innisfree since 2018, indicating the expected intensity of the upcoming proxy battle.

Legal Challenges and Corporate Governance

The backdrop to these developments includes a successful lawsuit by shareholder Richard Tornetta against Tesla, leading to what is known as the Tornetta decision. This lawsuit highlighted governance concerns, with the Delaware Chancery Court ruling that Musk had undue control over Tesla’s board, which compromised the negotiation process over his pay package.

Moving From Delaware to Texas

Amidst these controversies, Tesla is also pushing forward with plans to move its corporate base to Texas. This decision follows Musk’s public questioning of the benefits of being incorporated in Delaware, particularly after the court’s decision on his pay package. The board of Tesla has expressed that Texas represents the company’s future, despite acknowledging Delaware’s robust legal environment for corporate governance.

Shareholder Considerations

Tesla’s filing stressed the importance of shareholder awareness regarding the Delaware court’s criticisms of Tesla’s initial disclosures in 2018. The company also highlighted support from numerous institutional shareholders who disagreed with the court’s conclusions. As Tesla charts its path forward, the decisions at the upcoming shareholder meetings will be pivotal in shaping the company’s governance and geographical orientation.