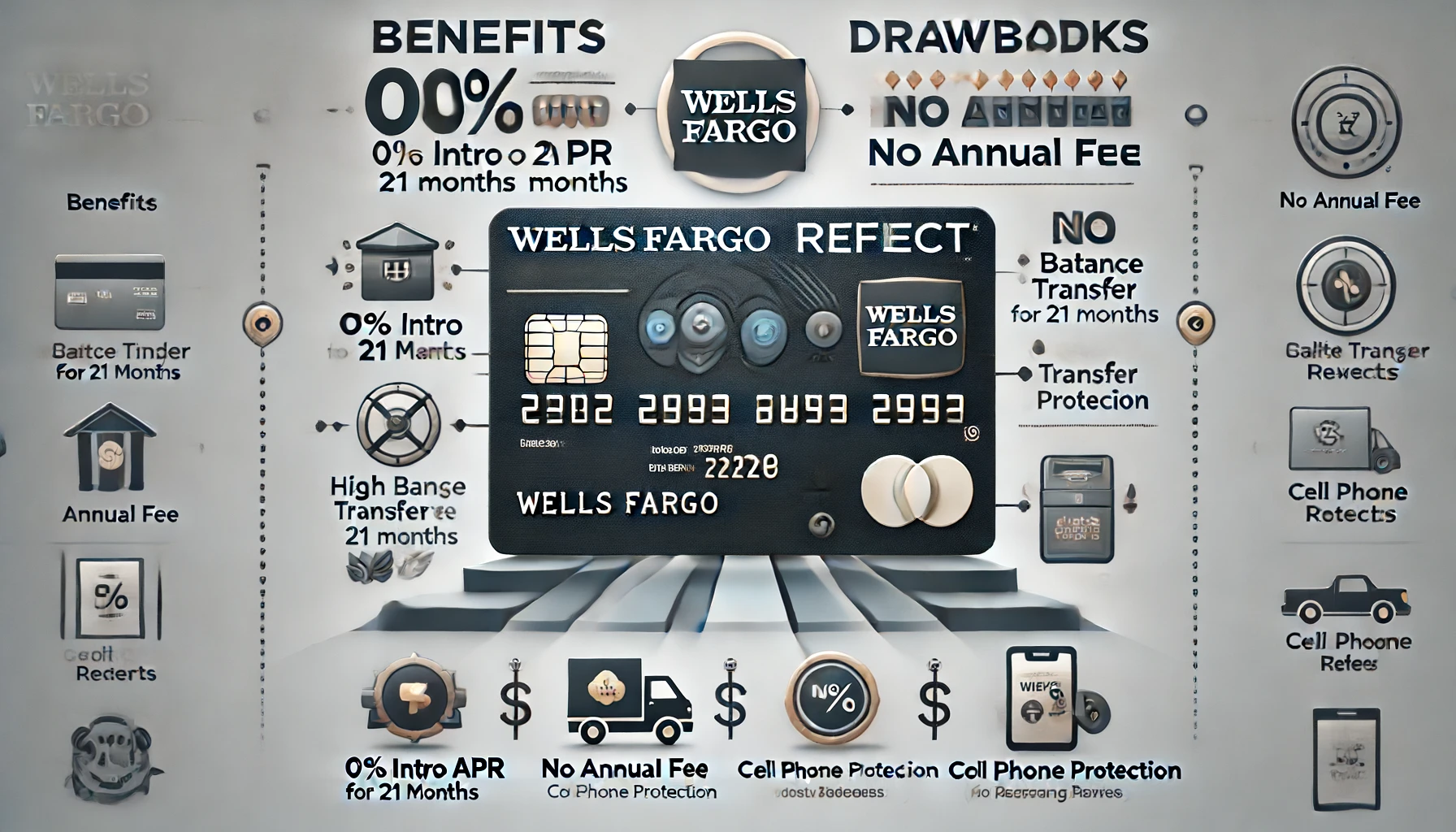

Discover the Benefits and Pitfalls of the Wells Fargo Reflect® Card

Choosing a credit card involves considering various factors, such as annual fees, rewards, and interest rates. The Wells Fargo Reflect® Card has garnered attention for its extended 0% intro APR offer, making it a popular choice for those looking to manage debt or finance significant purchases without the immediate burden of interest. However, like any financial product, it comes with its own set of pros and cons. In this article, we will dive deep into the features, benefits, and potential drawbacks of this card to help you make an informed decision.

Overview of the Wells Fargo Reflect® Card

Basic Information

Annual Fee: $0

Intro APR: 0% for 21 months on purchases and qualifying balance transfers

Regular APR: 18.24%, 24.74%, or 29.99% variable

Balance Transfer Fee: 5% (minimum $5)

Foreign Transaction Fee: 3%

Recommended Credit Score: 690-850 (Good to Excellent)

Key Features

The Wells Fargo Reflect® Card is designed with a primary focus on providing a lengthy 0% intro APR period, which is one of the longest in the market. This feature can be incredibly beneficial for those who need to consolidate debt or make large purchases without accruing interest immediately.

Benefits of the Wells Fargo Reflect® Card

Extra-Long 0% Intro APR Period

The standout feature of the Wells Fargo Reflect® Card is its 21-month 0% intro APR on purchases and qualifying balance transfers. This extended period can significantly reduce the cost of carrying a balance transferred from a high-interest card or financing a major purchase. After this period, the APR will revert to a variable rate between 18.24% and 29.99%, depending on your creditworthiness.

How This Helps You

Imagine you have a $5,000 balance on a credit card with a 20% APR. Transferring this balance to the Wells Fargo Reflect® Card could save you over $1,500 in interest over 21 months, assuming you pay it off before the intro period ends.

No Annual Fee

No annual fee is another attractive feature of this card. It means you can keep the card open without worrying about a yearly cost, which can be beneficial for maintaining a longer credit history—a factor that positively impacts your credit score.

Cell Phone Protection

The Wells Fargo Reflect® Card offers up to $600 in cell phone protection against damage or theft, subject to a $25 deductible. This benefit requires you to pay your monthly cell phone bill with the card. It’s a great perk for those looking to avoid paying extra for cell phone insurance.

Personalized Deals Through My Wells Fargo Deals

Cardholders can access personalized deals from various merchants through the My Wells Fargo Deals program. This feature allows you to earn cash back as a statement credit when you shop, dine, or enjoy experiences using your Wells Fargo Reflect® Card.

Drawbacks and Considerations

High Balance Transfer Fee

While the 0% intro APR is appealing, the balance transfer fee of 5% (minimum $5) can be substantial, especially for large transfers. For instance, transferring a $10,000 balance would incur a $500 fee, which could negate some of the benefits of the interest-free period if not carefully managed.

No Ongoing Rewards

One of the significant drawbacks of the Wells Fargo Reflect® Card is its lack of ongoing rewards. Once the 0% intro APR period ends, there are no incentives like cash back or travel points to make the card worth using for everyday purchases.

Comparing Alternatives

Other cards, like the Wells Fargo Active Cash® Card or the Chase Freedom Unlimited®, offer similar introductory APR periods but also provide ongoing rewards. For example, the Wells Fargo Active Cash® Card gives you 2% cash back on all purchases, and the Chase Freedom Unlimited® offers 5% cash back on travel, 3% on dining and drugstores, and 1.5% on other purchases.

Foreign Transaction Fee

If you frequently travel abroad, the 3% foreign transaction fee on the Wells Fargo Reflect® Card can add up. For a $1,000 international trip, you would pay an additional $30 in fees. There are other cards designed for travelers that don’t charge foreign transaction fees and offer travel-related perks.

Who Should Consider the Wells Fargo Reflect® Card?

Ideal Candidates

- Individuals with Good to Excellent Credit: With a recommended credit score range of 690-850, this card is best suited for those with good to excellent credit who can take advantage of the favorable APR terms.

- Debt Consolidators: If you’re looking to consolidate high-interest debt into a single, more manageable payment, the extended 0% intro APR can provide the breathing room needed to pay down balances without accruing additional interest.

- Large Purchasers: Planning a significant purchase like a home renovation or a new appliance? The lengthy interest-free period can help you spread out payments without the immediate pressure of interest.

Who Should Look Elsewhere?

- Reward Seekers: If you’re looking for a card that provides ongoing rewards for your spending, you might be better served by options like the Wells Fargo Active Cash® Card or the Chase Freedom Unlimited®.

- Frequent Travelers: Due to the foreign transaction fees, this card is not ideal for those who frequently travel internationally. Travel-focused cards like the Chase Sapphire Preferred® or the Capital One Venture Rewards Credit Card might be better options.

How to Apply for the Wells Fargo Reflect® Card

Steps to Apply

- Check Your Credit Score: Ensure your credit score falls within the recommended range (690-850).

- Visit the Wells Fargo Website: Navigate to the Wells Fargo Reflect® Card page.

- Click “Apply Now”: Fill out the application form with accurate and up-to-date information.

- Review Terms and Conditions: Carefully read the terms and conditions before submitting your application.

- Submit Your Application: Wait for approval, which may be instant or take a few days.

What to Expect After Applying

- Approval Process: If approved, you’ll receive your card within 7-10 business days.

- Activate Your Card: Once you receive your card, activate it by following the instructions provided.

- Start Using Your Card: Begin using your card to take advantage of the 0% intro APR period for purchases and balance transfers.

Conclusion

The Wells Fargo Reflect® Card offers substantial benefits for those looking to manage debt or finance large purchases with its extended 0% intro APR period. However, it’s essential to weigh these benefits against the drawbacks, such as the high balance transfer fee and lack of ongoing rewards. By understanding your financial needs and spending habits, you can determine if this card is the right fit for you.

Remember, the key to maximizing any credit card is to use it responsibly, pay off balances promptly, and stay informed about the terms and conditions. Happy financial planning!

This comprehensive review aims to provide you with all the necessary information to make an informed decision about the Wells Fargo Reflect® Card. If you have any further questions or need personalized advice, don’t hesitate to reach out to financial experts or your bank.