Amex Business Platinum Card Review 2024

The Amex Business Platinum Card: Unmatched Perks for High-Spending Entrepreneurs

If you’re a small business owner with significant travel and tech expenses, the Amex Business Platinum Card could be your ticket to luxury and savings.

The Amex Business Platinum Card Overview

The Business Platinum Card® from American Express is a premier travel and rewards card tailored for small business owners. It comes with a $695 annual fee, but for those who can leverage its extensive benefits, the value can far exceed the cost. From airport lounge access to multiple statement credits, this card is packed with features that cater to frequent travelers and businesses with substantial expenditures.

Key Features

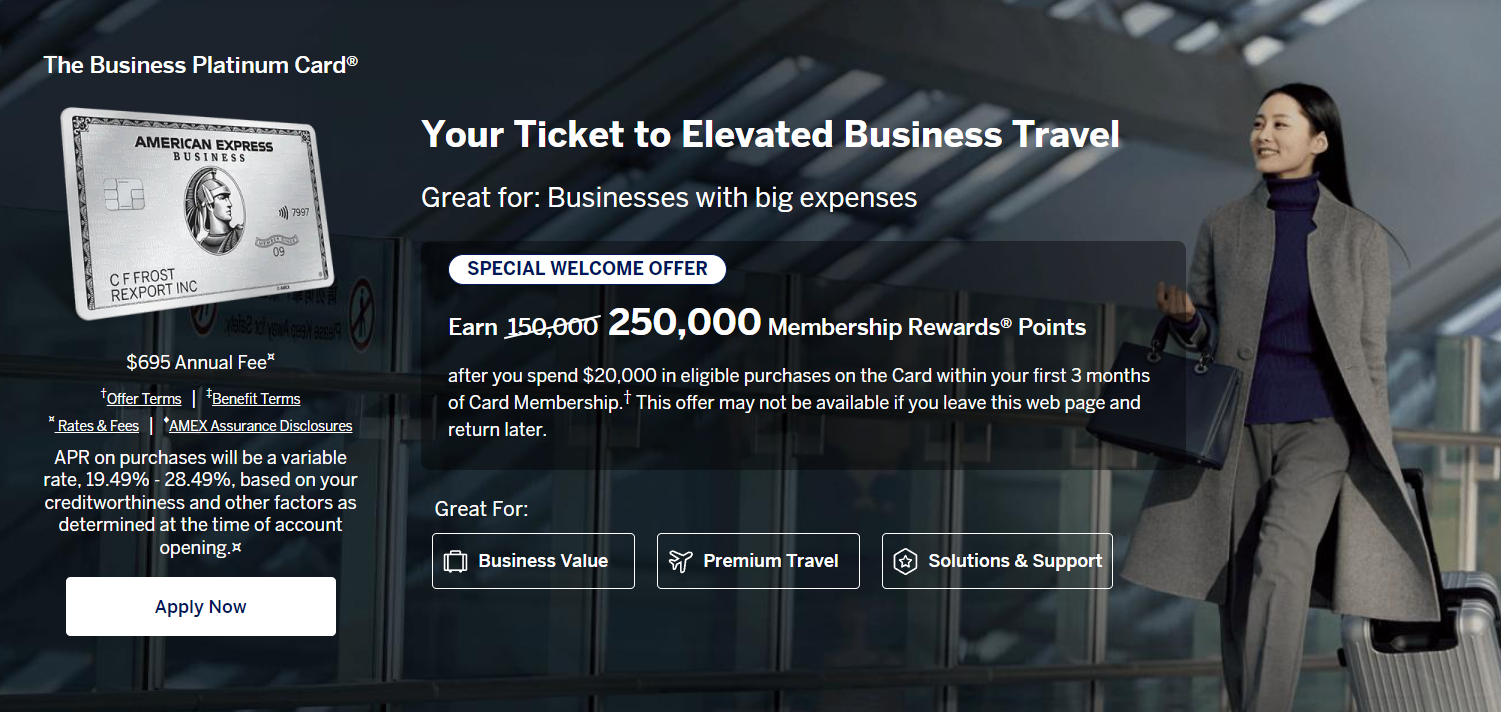

Welcome Bonus

Earn 150,000 Membership Rewards® Points

New cardholders can earn 150,000 Membership Rewards® points after spending $20,000 on eligible purchases within the first three months. While this spending requirement is high, the reward points are highly valuable due to their flexibility.

Reward Rates

- 5X Points: On flights and prepaid hotels booked through Amex Travel.

- 1.5X Points: On eligible purchases at U.S. construction material and hardware suppliers, electronic goods retailers, software and cloud system providers, and shipping providers, as well as purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- 1X Point: On all other eligible purchases.

Annual Fee

The card comes with a $695 annual fee, which can be offset by the array of benefits it offers.

Benefits and Perks

Travel Benefits

Airport Lounge Access

Cardholders enjoy complimentary access to over 1,400 airport lounges worldwide, including The Centurion Lounge and Delta Sky Clubs, providing a comfortable space to relax before flights.

Hotel Elite Status

Receive Gold elite status with Marriott Bonvoy and Hilton Honors, which includes perks like room upgrades and late check-out.

$200 Airline Fee Credit

Select one qualifying airline and receive up to $200 in statement credits per calendar year for incidental fees charged by the airline.

Global Entry or TSA PreCheck Credit

Get reimbursed for the application fee for Global Entry (up to $100) or TSA PreCheck (up to $85).

Business-Centered Credits

Dell Technologies Credit

Receive up to $200 in statement credits annually for U.S. Dell purchases, split into two $100 credits per half-year.

Indeed Credit

Get up to $360 in annual statement credits for Indeed hiring and recruiting products, up to $90 per quarter.

Adobe Credit

Earn up to $150 in statement credits annually on select Adobe purchases.

Wireless Credit

Receive up to $120 in annual statement credits for purchases made directly from U.S. wireless telephone providers.

Travel and Shopping Protections

Trip Delay and Cancellation Insurance

Reimbursement for eligible prepaid expenses if your trip is delayed or canceled for a covered reason.

Car Rental Loss and Damage Insurance

Secondary coverage for auto rentals when you decline the rental company’s collision damage waiver.

Extended Warranty and Purchase Protection

Get additional warranty coverage and protection for purchases made with the card.

Baggage Insurance

Coverage for lost, damaged, or stolen baggage.

Fees and APR

| Fee Type | Cost |

|---|---|

| Annual Membership Fee | $695 |

| Foreign Transaction Fees | None |

| Late Payment Fee | $39 or 2.99% of any past due Pay in Full amount, whichever is greater |

| Returned Payment Fee | $39 |

APR

- Regular APR: 19.49% – 28.49% Variable

- Penalty APR: 29.99% (applies if you make 2 or more late payments in a 12-month period)

How We Calculate Your Balance

The balance is calculated using the “average daily balance (including new transactions)” method. Variable APRs are based on the Prime Rate and will not exceed 29.99%.

Earning and Redeeming Rewards

Earning Rewards

The Amex Business Platinum Card excels in offering Membership Rewards® points, which can be accumulated quickly through strategic spending, especially in bonus categories like travel and large purchases.

Redeeming Rewards

Membership Rewards points offer multiple redemption options, making them one of the most flexible and valuable currencies in the market. Points can be transferred to various airline and hotel partners, providing potential for significant value when booking flights or hotel stays.

Example Redemption

Booking a Flight

If you redeem 10,680 points for a $106.80 round-trip flight from Dallas-Fort Worth to Las Vegas, you can receive a 35% rebate on the points if American Airlines is your selected airline. This results in a net cost of just 6,942 points, effectively giving you 1.54 cents per point in value.

Other Redemptions

Points can also be used for hotel stays, car rentals, cruises, and various other travel and shopping expenses, though some options provide less value than transferring to travel partners.

Pros and Cons

Pros

- Excellent Welcome Bonus: The 150,000 points offer is highly valuable.

- Extensive Lounge Access: Complimentary access to a vast network of lounges.

- Valuable Travel and Shopping Benefits: Including insurance and protection perks.

- Multiple Statement Credits: Can offset the annual fee significantly.

Cons

- High Annual Fee: $695 can be prohibitive for some businesses.

- High Spending Requirement: To earn the welcome bonus.

- Complex Credits: Some credits are incremental, making them harder to utilize fully.

- Limited Bonus Categories: Only a few categories earn elevated rewards.

Frequently Asked Questions (FAQ)

Is the Amex Business Platinum Card worth the annual fee?

For businesses that can maximize the travel benefits and statement credits, the value derived from the card can exceed the $695 annual fee. However, it may not be worth it for businesses with lower spending or those that cannot utilize the specific benefits.

How do the statement credits work?

Many of the statement credits require enrollment and are applied to specific types of purchases, such as Dell Technologies, Indeed, Adobe, and wireless telephone services. These credits are typically issued in specific increments and may have caps.

What are the travel insurance benefits?

The card offers various travel insurance protections, including trip delay and cancellation insurance, car rental loss and damage insurance, and baggage insurance. These protections can provide financial reimbursement for covered incidents during travel.

How can I redeem Membership Rewards points?

Points can be redeemed through the American Express Travel portal, transferred to airline and hotel partners, used for shopping, and more. The most valuable redemptions typically involve transferring points to travel partners for flights and hotel stays.

Are there any foreign transaction fees?

No, the Amex Business Platinum Card does not charge foreign transaction fees, making it an excellent choice for international business travel.

The Amex Business Platinum Card is a powerhouse for small business owners who travel frequently and have significant expenditures in eligible categories. While the $695 annual fee is steep, the extensive benefits, including travel perks, statement credits, and flexible rewards, can provide substantial value for those who can fully utilize them. As with any premium card, it’s essential to assess your spending habits and travel needs to determine if this card is the right fit for your business.