Wells Fargo Balance Transfers: A Comprehensive Review

Discover the Benefits and Considerations of Wells Fargo Balance Transfers

When it comes to managing high-interest debt, a balance transfer can be a powerful financial tool. In this article, we delve into the ins and outs of balance transfers with Wells Fargo, examining the benefits, potential drawbacks, and key considerations to help you make an informed decision.

Wells Fargo offers several credit card options with attractive balance transfer features, which we will explore in detail.

Wells Fargo Reflect® Card

The Wells Fargo Reflect® Card stands out for its lengthy introductory 0% APR period on both purchases and qualifying balance transfers. This card offers:

- 0% Intro APR: For 21 months from account opening on purchases and qualifying balance transfers. After that, a variable APR of 18.24%, 24.74%, or 29.99% applies.

- Balance Transfer Fee: 5% of the amount transferred, with a minimum fee of $5.

- No Annual Fee: Making it a cost-effective option for balance transfers.

- Additional Perks: Includes up to $600 of cell phone protection when you pay your monthly phone bill with the card (subject to a $25 deductible) and 24/7 roadside dispatch.

Wells Fargo Active Cash® Card

The Wells Fargo Active Cash® Card is another strong contender, offering a balance of introductory APR benefits and ongoing rewards:

- 0% Intro APR: For 15 months from account opening on purchases and qualifying balance transfers. After that, a variable APR of 20.24%, 25.24%, or 29.99% applies.

- Balance Transfer Fee: 3% of the amount transferred within the first 120 days, then up to 5%, with a minimum fee of $5.

- No Annual Fee: Keeping costs low for those looking to transfer balances.

- Cash Rewards: Cardholders earn a $200 cash rewards bonus after spending $500 in purchases within the first 3 months, and 2% cash rewards on all purchases.

- Additional Benefits: Up to $600 of cell phone protection and 24/7 access to Visa Signature Concierge.

Balance Transfer Comparison Table

| Feature | Wells Fargo Reflect® Card | Wells Fargo Active Cash® Card |

|---|---|---|

| Intro APR Period | 0% for 21 months | 0% for 15 months |

| Variable APR After Intro Period | 18.24%, 24.74%, or 29.99% | 20.24%, 25.24%, or 29.99% |

| Balance Transfer Fee | 5% (min $5) | 3% for 120 days, then 5% (min $5) |

| Annual Fee | $0 | $0 |

| Cash Rewards | N/A | $200 bonus + 2% on all purchases |

| Cell Phone Protection | Up to $600 | Up to $600 |

| Visa Signature Concierge | Yes | Yes |

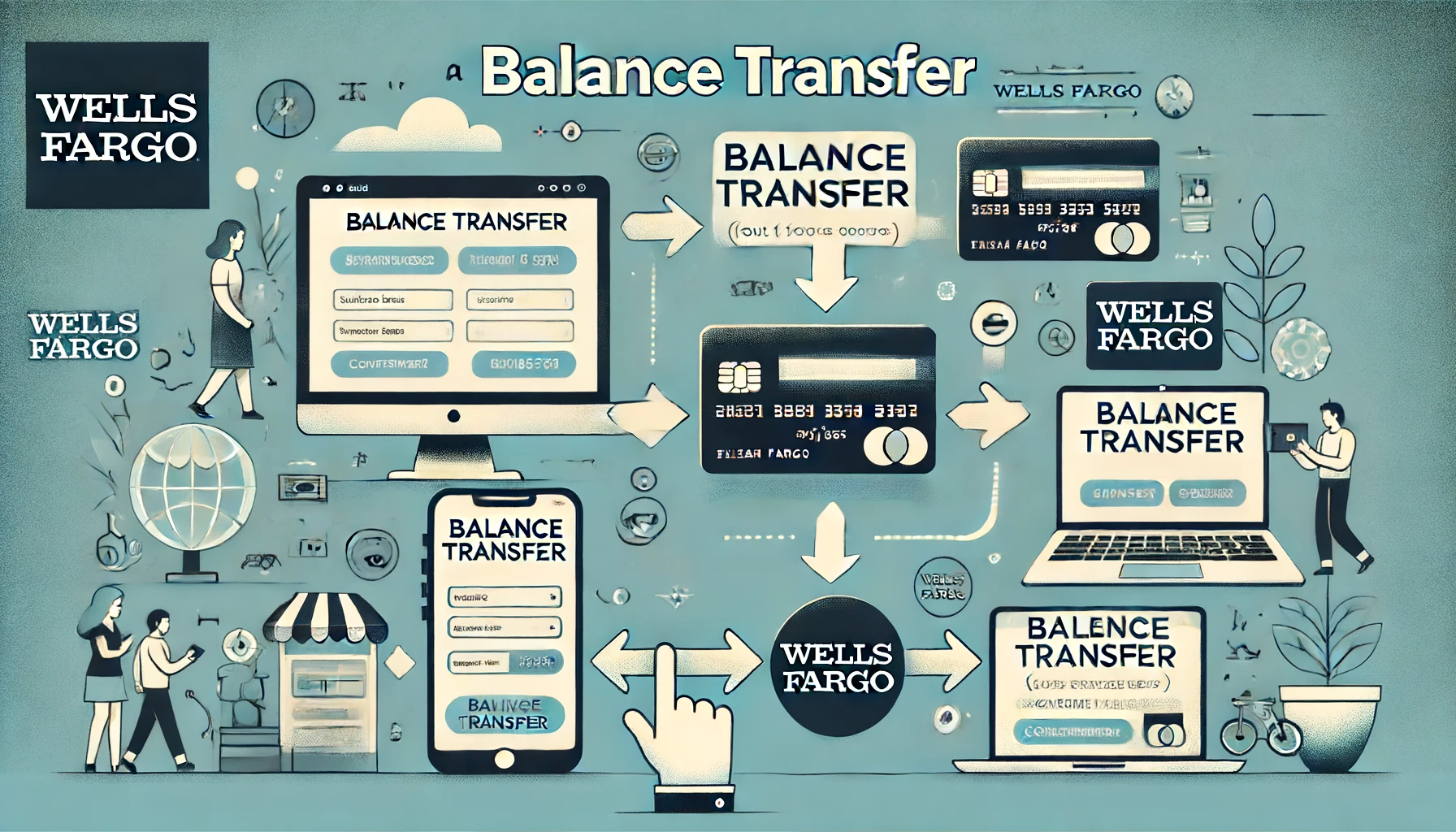

How to Initiate a Balance Transfer with Wells Fargo

Initiating a balance transfer with Wells Fargo is straightforward. Here’s a step-by-step guide:

- Log Into Your Account: Access the Credit Card Service Center using your account information.

- Select Balance Transfer: Under Account Management, choose Request Balance Transfer.

- Provide Details: Specify the amount you’d like to transfer and the account from which the debt is being moved.

- Confirm and Submit: Review the terms and submit your request.

Alternatively, you can initiate a balance transfer by calling Wells Fargo at 1-800-642-4720.

What to Expect During the Balance Transfer Process

- Processing Time: It may take up to 14 days for the balance transfer to post to your new or existing Wells Fargo credit card account.

- Credit Limit Considerations: Ensure the total balance transfer amount, including fees, does not exceed your available credit limit. If it does, Wells Fargo may transfer a lower amount or decline the transfer.

- Impact on Available Credit: The requested balance transfer amount plus any fees will be reflected in your account balance and credit limit once processed.

Key Considerations for Balance Transfers

While balance transfers offer several advantages, it’s essential to be aware of potential pitfalls:

Avoiding Interest Charges

To maximize the benefits of a balance transfer, aim to pay off your balance within the promotional APR period. Calculate the monthly payment required to clear the balance by the end of the intro period, including any transfer fees. Making only the minimum payment might not be sufficient to avoid interest charges once the promotional period ends.

New Purchases

It’s advisable to avoid making new purchases on the balance transfer card. New spending can increase your debt and make it challenging to pay off the transferred balance within the intro period.

Credit Score Impact

Balance transfers can affect your credit score. Applying for a new credit card involves a hard inquiry, which can temporarily lower your credit score. Additionally, transferring a balance to a new card increases your credit utilization on that card, which might impact your score.

Frequently Asked Questions (FAQs)

How long does a balance transfer take to post to my account?

It may take up to 14 days for a balance transfer initiated with Wells Fargo to complete.

Is there a limit to how much you can transfer to a Wells Fargo credit card?

Yes, the amount approved for transfer will be up to your available credit limit, including the balance transfer fee.

Who can do a balance transfer with Wells Fargo?

Existing Wells Fargo cardholders and new applicants can request a balance transfer. However, those who have opened a Wells Fargo credit card in the past six months may not qualify for another one.

Will a Wells Fargo balance transfer earn rewards?

No, balance transfers do not earn rewards and do not count toward any sign-up bonuses offered.

Can you transfer a balance from Wells Fargo to another issuer?

Yes, you can transfer an existing balance from a Wells Fargo credit card to a card with a different issuer, assuming that card allows balance transfers.

Wells Fargo offers two compelling credit card options for those considering a balance transfer. The Reflect® Card provides an extended 0% intro APR period, making it ideal for those needing more time to pay off their transferred balance. The Active Cash® Card combines a shorter intro APR period with valuable cash rewards, offering ongoing benefits even after the balance is paid off.

When deciding whether a balance transfer is right for you, consider the transfer fees, intro APR period, and your ability to pay off the balance within the promotional period. Balance transfers can be a strategic way to manage high-interest debt, but they require careful planning and discipline to maximize their benefits.